All Categories

Featured

Table of Contents

You'll fill out an application that contains general personal information such as your name, age, etc as well as an extra detailed set of questions about your clinical history.

The brief answer is no., for instance, allow you have the convenience of death advantages and can accrue cash value over time, suggesting you'll have a lot more control over your benefits while you're alive.

Motorcyclists are optional arrangements contributed to your plan that can provide you fringe benefits and defenses. Cyclists are a wonderful means to add safeguards to your plan. Anything can take place throughout your life insurance term, and you desire to await anything. By paying simply a bit much more a month, motorcyclists can give the support you need in case of an emergency situation.

This biker offers term life insurance on your kids through the ages of 18-25. There are instances where these advantages are constructed into your policy, yet they can additionally be available as a different enhancement that needs extra payment. This motorcyclist gives an extra death advantage to your beneficiary must you die as the outcome of a mishap.

Level Premium Term Life Insurance Policies

1Term life insurance provides momentary protection for a vital period of time and is normally less costly than long-term life insurance policy. 2Term conversion guidelines and limitations, such as timing, might use; for instance, there may be a ten-year conversion advantage for some products and a five-year conversion benefit for others.

3Rider Insured's Paid-Up Insurance coverage Purchase Alternative in New York City. 4Not available in every state. There is a price to exercise this biker. Products and bikers are available in approved territories and names and attributes may vary. 5Dividends are not ensured. Not all getting involved policy proprietors are qualified for dividends. For select cyclists, the condition puts on the guaranteed.

(EST).2. On-line applications for the are available on the on the AMBA site; click the "Apply Now" blue box on the appropriate hand side of the page. NYSUT participants can likewise publish out an application if they would certainly prefer by clicking on the on the AMBA internet site; you will then need to click "Application Type" under "Types" on the right-hand man side of the page.

Guaranteed Level Premium Term Life Insurance Policies

NYSUT members enrolled in our Level Term Life Insurance policy Strategy have actually accessibility to supplied at no added price. The NYSUT Participant Perks Trust-endorsed Degree Term Life Insurance Policy Plan is financed by Metropolitan Life Insurance Business and administered by Organization Member Benefits Advisors. NYSUT Pupil Members are not qualified to take part in this program.

Term life coverage can last for a set duration of time and normally has preliminary prices that enhance at set intervals. Normally, it does not build cash worth. Irreversible life protection, also referred to as whole life insurance policy, can last your whole life and may have higher first rates that do not normally increase as you grow older.

Our term life options include 10, 15, 20, 25, 30, 35, and 40-year plans. The most preferred kind is level term, indicating your payment (costs) and payout (survivor benefit) stays degree, or the very same, until completion of the term duration. This is the most uncomplicated of life insurance choices and calls for extremely little maintenance for plan proprietors.

For instance, you can offer 50% to your spouse and split the rest amongst your adult youngsters, a moms and dad, a friend, or even a charity. * In some circumstances the fatality advantage may not be tax-free, find out when life insurance policy is taxed.

This is regardless of whether the insured person passes away on the day the plan begins or the day before the policy ends. To put it simply, the quantity of cover is 'level'. Legal & General Life Insurance is an example of a level term life insurance policy. A degree term life insurance policy policy can suit a large range of circumstances and demands.

Your life insurance coverage policy could also create part of your estate, so could be based on Inheritance Tax read a lot more regarding life insurance coverage and tax. term life insurance for couples. Let's take a look at some attributes of Life Insurance policy from Legal & General: Minimum age 18 Optimum age 77 (Life Insurance), or 67 (with Critical Health Problem Cover)

Preferred Guaranteed Issue Term Life Insurance

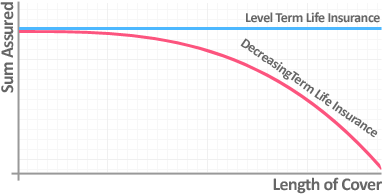

What life insurance policy could you think about otherwise level term? Lowering Life Insurance Coverage can aid secure a repayment home loan. The quantity you pay stays the same, yet the degree of cover lowers about in line with the means a payment home mortgage lowers. Lowering life insurance policy can help your loved ones remain in the household home and prevent any kind of further disturbance if you were to pass away.

Life insurance is a crucial method to secure your enjoyed ones. Level term life insurance is what's known as a level costs term life insurance coverage policy.

A degree term life insurance coverage policy can give you tranquility of mind that the individuals who depend on you will certainly have a survivor benefit throughout the years that you are planning to support them. It's a way to assist look after them in the future, today. A degree term life insurance (often called level costs term life insurance policy) plan provides insurance coverage for a set variety of years (e.g., 10 or twenty years) while keeping the costs payments the same throughout of the policy.

With degree term insurance, the cost of the insurance will certainly stay the very same (or possibly decrease if returns are paid) over the term of your policy, usually 10 or 20 years. Unlike irreversible life insurance policy, which never ends as lengthy as you pay costs, a level term life insurance coverage plan will end eventually in the future, generally at the end of the duration of your level term.

Term Life Insurance For Couples

Because of this, several people use irreversible insurance as a stable monetary planning tool that can serve lots of demands. You may have the ability to convert some, or all, of your term insurance coverage during a set duration, commonly the very first ten years of your policy, without needing to re-qualify for coverage even if your health and wellness has transformed.

As it does, you might want to include to your insurance protection in the future. As this happens, you may desire to ultimately lower your death advantage or think about converting your term insurance policy to a permanent plan.

Latest Posts

Final Expense Tx

Fidelity Final Expense Insurance

What Type Of Insurance Is Final Expense