All Categories

Featured

Table of Contents

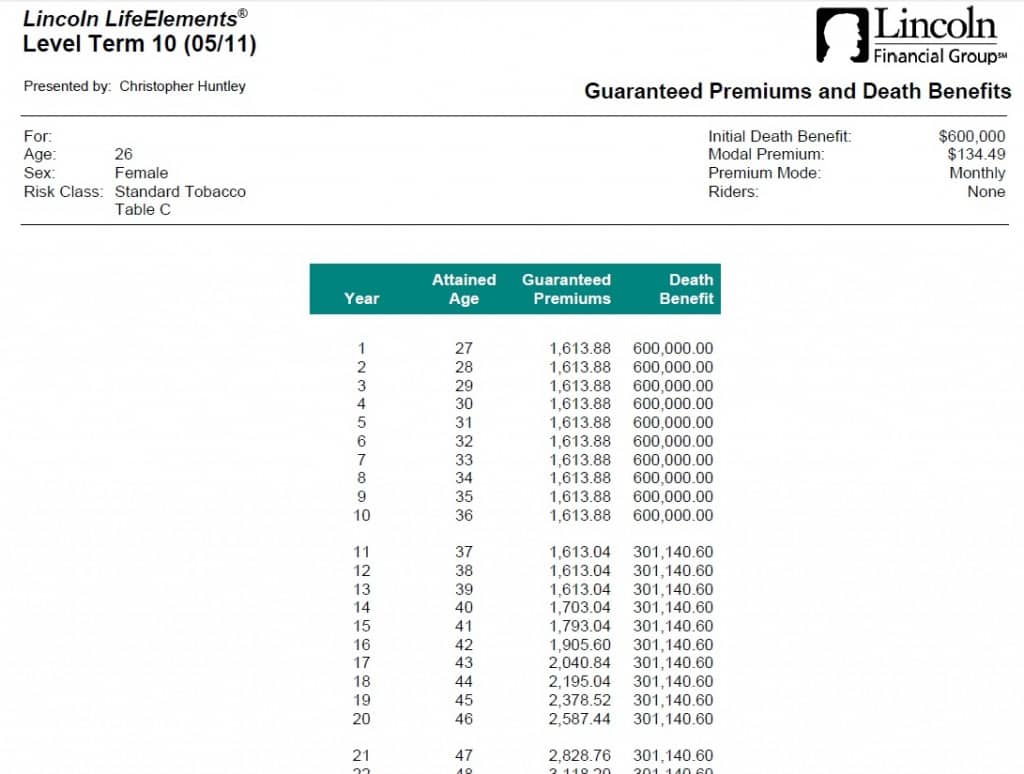

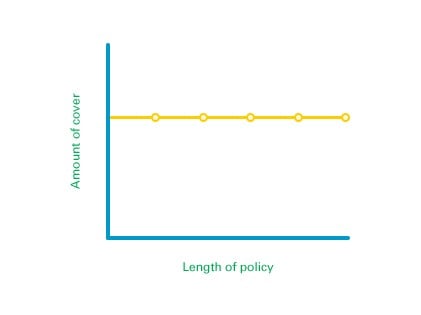

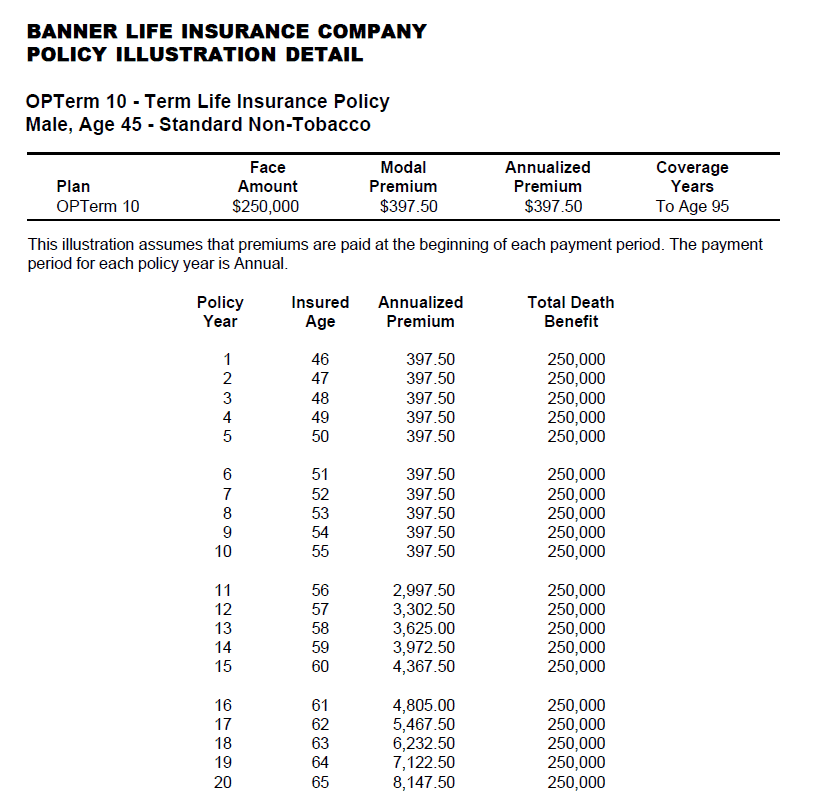

If you choose degree term life insurance policy, you can allocate your premiums because they'll stay the exact same throughout your term. Plus, you'll understand exactly just how much of a fatality benefit your recipients will certainly get if you pass away, as this quantity will not alter either. The rates for level term life insurance will certainly depend on several aspects, like your age, health standing, and the insurance policy firm you choose.

Once you go with the application and medical examination, the life insurance coverage company will evaluate your application. They should notify you of whether you've been approved soon after you use. Upon approval, you can pay your very first premium and sign any type of pertinent documentation to guarantee you're covered. From there, you'll pay your premiums on a month-to-month or yearly basis.

You can pick a 10, 20, or 30 year term and delight in the included peace of mind you are entitled to. Working with an agent can help you find a policy that functions best for your needs.

As you try to find methods to safeguard your financial future, you have actually most likely encountered a wide array of life insurance policy alternatives. group term life insurance tax. Choosing the best protection is a large choice. You wish to discover something that will certainly assist sustain your enjoyed ones or the reasons important to you if something happens to you

Lots of people lean towards term life insurance coverage for its simpleness and cost-effectiveness. Level term insurance, nonetheless, is a kind of term life insurance that has consistent settlements and an unchanging.

Specialist What Is Decreasing Term Life Insurance

Degree term life insurance is a part of It's called "degree" due to the fact that your premiums and the advantage to be paid to your enjoyed ones remain the very same throughout the agreement. You won't see any adjustments in cost or be left wondering regarding its worth. Some agreements, such as annually renewable term, might be structured with costs that increase gradually as the insured ages.

Dealt with death advantage. This is also established at the start, so you can recognize exactly what death advantage amount your can expect when you die, as long as you're covered and updated on costs.

You agree to a set premium and fatality benefit for the period of the term. If you pass away while covered, your death benefit will certainly be paid out to loved ones (as long as your premiums are up to date).

You might have the alternative to for an additional term or, extra likely, restore it year to year. If your contract has actually a guaranteed renewability provision, you might not require to have a brand-new medical exam to maintain your coverage going. Your premiums are likely to increase due to the fact that they'll be based on your age at renewal time.

With this option, you can that will last the remainder of your life. In this instance, once again, you may not require to have any brand-new medical examinations, however premiums likely will rise as a result of your age and new coverage. a term life insurance policy matures. Different companies use numerous options for conversion, make certain to comprehend your selections prior to taking this action

Long-Term Term 100 Life Insurance

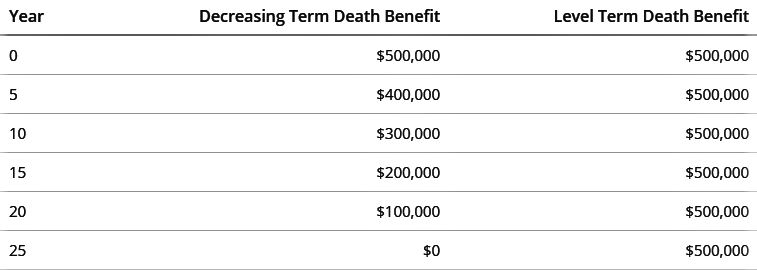

The majority of term life insurance policy is level term for the duration of the contract period, yet not all. With decreasing term life insurance policy, your death benefit goes down over time (this kind is frequently taken out to particularly cover a lasting debt you're paying off).

And if you're established for renewable term life, after that your costs likely will increase every year. If you're exploring term life insurance and desire to make certain simple and foreseeable economic security for your family, level term may be something to consider. As with any type of protection, it may have some constraints that do not fulfill your needs.

Guaranteed Issue Term Life Insurance

Commonly, term life insurance is a lot more cost effective than irreversible insurance coverage, so it's a cost-effective means to protect economic protection. Adaptability. At the end of your contract's term, you have numerous alternatives to proceed or go on from protection, often without requiring a medical examination. If your budget plan or insurance coverage requires adjustment, fatality benefits can be decreased over time and lead to a lower premium.

Similar to other type of term life insurance policy, once the agreement ends, you'll likely pay greater premiums for coverage due to the fact that it will recalculate at your current age and health. Taken care of coverage. Level term provides predictability. If your monetary circumstance modifications, you may not have the necessary insurance coverage and could have to acquire added insurance.

That does not suggest it's a fit for every person. As you're purchasing life insurance policy, below are a couple of vital aspects to consider: Budget plan. Among the benefits of degree term protection is you understand the price and the fatality benefit upfront, making it simpler to without fretting about increases with time.

Age and health and wellness. Generally, with life insurance, the much healthier and younger you are, the a lot more budget-friendly the coverage. If you're young and healthy, it may be an enticing choice to secure in low costs now. Financial obligation. Your dependents and financial responsibility contribute in determining your protection. If you have a young family, as an example, level term can help give financial backing throughout vital years without spending for protection longer than needed.

1 All bikers go through the conditions of the rider. All motorcyclists might not be offered in all jurisdictions. Some states may differ the conditions (what is direct term life insurance). There may be a surcharge connected with obtaining particular bikers. Some motorcyclists might not be readily available in mix with other riders and/or plan features.

2 A conversion credit is not readily available for TermOne policies. 3 See Term Conversions section of the Term Series 160 Product Guide for how the term conversion credit report is identified. A conversion credit history is not readily available if premiums or costs for the brand-new plan will certainly be waived under the regards to a rider offering disability waiver benefits.

Innovative Term Vs Universal Life Insurance

Term Collection items are provided by Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Coverage Agency of The Golden State, LLC in CA; Equitable Network Insurance Company of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance is a kind of life insurance plan that covers the policyholder for a details amount of time, which is understood as the term. Terms typically vary from 10 to 30 years and increase in 5-year increments, providing level term insurance coverage.

Latest Posts

Final Expense Tx

Fidelity Final Expense Insurance

What Type Of Insurance Is Final Expense